Nikki Sixx and MÖTLEY CRÜE are trying to remove 73-year-old Mick Mars from the band’s corporation and any other businesses, so they may essentially continue on with a new guitarist, John 5, who will be paid as an employee only) and has no history with the band in terms of touring with the group in support of their previously released studio albums.

The issue of whether Mick Mars was legally severed from MÖTLEY CRÜE is heading to private arbitration later this year in 2024.

Mick’s legal team contends that Sixx, Lee and Neil are attempting to steal the comeback touring profits owed to Mick Mars in 2023 going into 2024 and divvy it up amongst themselves and Allen Kovac the band manager.

When Mars, a co-founding member of MÖTLEY CRÜE, announced his retirement from touring with the group in October 2022, he maintained that he would remain a member of the band, with John 5 taking his place on the road.

He made it perfectly clear he was not retiring from the band, and that he would be available for recording new music in the studio and perform at a residency and/or select historic rock venues only, due to his advancing age.

However, Mick filed a lawsuit against the band in April 2023, saying that, after his announcement, the rest of MÖTLEY CRÜE tried to remove him from the group’s corporation and business holdings via a shareholders’ meeting.

Motley Crue Responds to Mick Mars’ Lawsuit, Contending He Quit After ‘Struggling to Remember Chords, Playing the Wrong Songs’; Nikki Sixx Says ‘Sad Day for Us’

A shareholder is someone who owns stock in a company.

At the core of the dispute is whether Mars, who is a 25% shareholder in Mötley Crüe’s businesses, can remain a shareholder, or even a member of the band.

It is Mick’s assertion that he named the band and secured their first producer, along with being the only one who actually played his instrument on MÖTLEY CRÜE studio recordings and in concerts, and actually wrote their most recognizable riffs and guitar solos.

Mick claims that the band’s 36 North American tour dates for The Stadium Tour were the worst shows he ever performed with the band in 41 years and that he can prove the band intentionally engaged in “gaslighting” the legendary guitarist and saying that he was in essence too old to be in the band anymore.

If you want to remove a shareholder, you first must decide if the shareholder is leaving the company voluntarily or involuntarily.

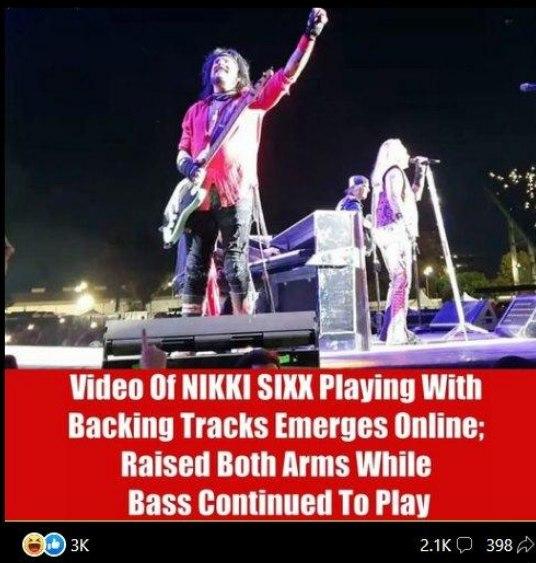

In the case of Mick Mars versus MÖTLEY CRÜE, Mick claims that he was fired by the band after trying to stop going out on worldwide tours with the group once legendary rock journalist Randy “Rocket” Cody of TMD exposed Nikki Sixx, Tommy Lee and Vince Neil were using prerecorded audio tape at their comeback The Stadium Tour for main instrumentation and lead vocals in effort to try and sabotage Mick Mars and ruin his legacy.

Immediately and without even allowing Mick to say goodbye to the fans from the stage at the final Stadium Tour concert his 25% share was reduced down to 5%, after which they made a final offer to him of 7%.

So, Mick was ‘involuntarily’ removed by Sixx, Lee and Neil.

The paperwork was filed in Los Angeles County’s Superior Court filed this past January through Mars’ attorney, Edwin F. McPherson, and says the band has deliberately withheld information about the various Motley Crue businesses that he has a 25% ownership share in.

“The requests were not burdensome. Yet, Mars was compelled to file suit, and it appears plain that production would not have occurred without it. Mars is entitled to attorney fees,” Los Angeles Superior Court Judge James C. Chalfant said in his ruling [via Rolling Stone].

Mars says the band demanded he sign a severance agreement that would divest him of those and other future interests, in return for a 5% stake in the group’s future tours, which continue going on without him.

After Mars refused to sign the papers, the band took the dispute to private arbitration rather than a public lawsuit so that the public would not be aware of the deplorable manner in which they treated their ‘brother’ of 41 years,” Mick claimed in the lawsuit.

What legal grounds does MÖTLEY CRÜE have to remove Mick Mars?

For involuntary removals, the shareholder will usually need to have violated the shareholders agreement or company bylaws before they can be forced out of the company.

Shareholder agreements differ from company bylaws.

Bylaws work in conjunction with a company’s articles of incorporation to form the legal backbone of the business and govern its operations. A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

Removing a Shareholder | UpCounsel 2024

Upcounsel site breaks it down for us in black and white:

Creating a shareholder removal resolution should be your next step. After drafting the resolution, you should present it to your corporation’s board of directors. Depending on your shareholders agreement, you may instead need to present the resolution to a specific group of shareholders.

The resolution needs to include the correct information before you can remove a shareholder. For instance, you need to explain the reason for removing the shareholder and include a buyout request. If you want the resolution to be as effective as possible, your reasons for removing the shareholder should include a bylaw violation. With an S corporation, for example, you could state that you are removing the shareholder because they no longer meet the Internal Revenue Service (IRS) qualifications for serving as an S corp shareholder.

An involuntary removal can only occur if your shareholders agreement describes the process for such a removal. Otherwise, you cannot force out a shareholder until they have violated the corporate statute. In most cases, this would mean that the shareholder has committed fraud. After everything is in order, your corporate secretary and board of directors should sign the removal resolution.

Next, you should convene a meeting of your company’s governing board to vote on the resolution. If the board passes the resolution, you’ll need another signature from your corporate secretary.

If there is no shareholders agreement in place, or if the shareholder to be removed hasn’t violated company rules, the resolution must pass by a 75 percent majority vote. Also, the shareholder in question cannot own more than 25 percent of the company’s shares.

Now the court during the private arbitration scheduled to happen later in 2024 could find that the current shareholders attempting to oust MICK MARS are ‘culpable’ and have all committed fraud themselves and decide to award Mick back his original percentage of shares plus more (via damages) to potentially give him majority shareholder status and basically allow him to take over control of the band, depending on what evidence is brought forth and made admissible.

Technically, this means that any previous meeting to remove him is voided and if Mick is indeed awarded just one percent more than his original 25% that he once held, he would not be able to be ‘voted out’ of MÖTLEY CRÜE.

Culpable

adj. sufficiently responsible for criminal acts or negligence to be at fault and liable for the conduct.

More Stories

HOUR OF PENANCE – “Sedition” to be Reissued on Vinyl

ELECTRIC TEMPLE – Debut Album Announced

SEPTICFLESH – 2025 North American Tour Dates